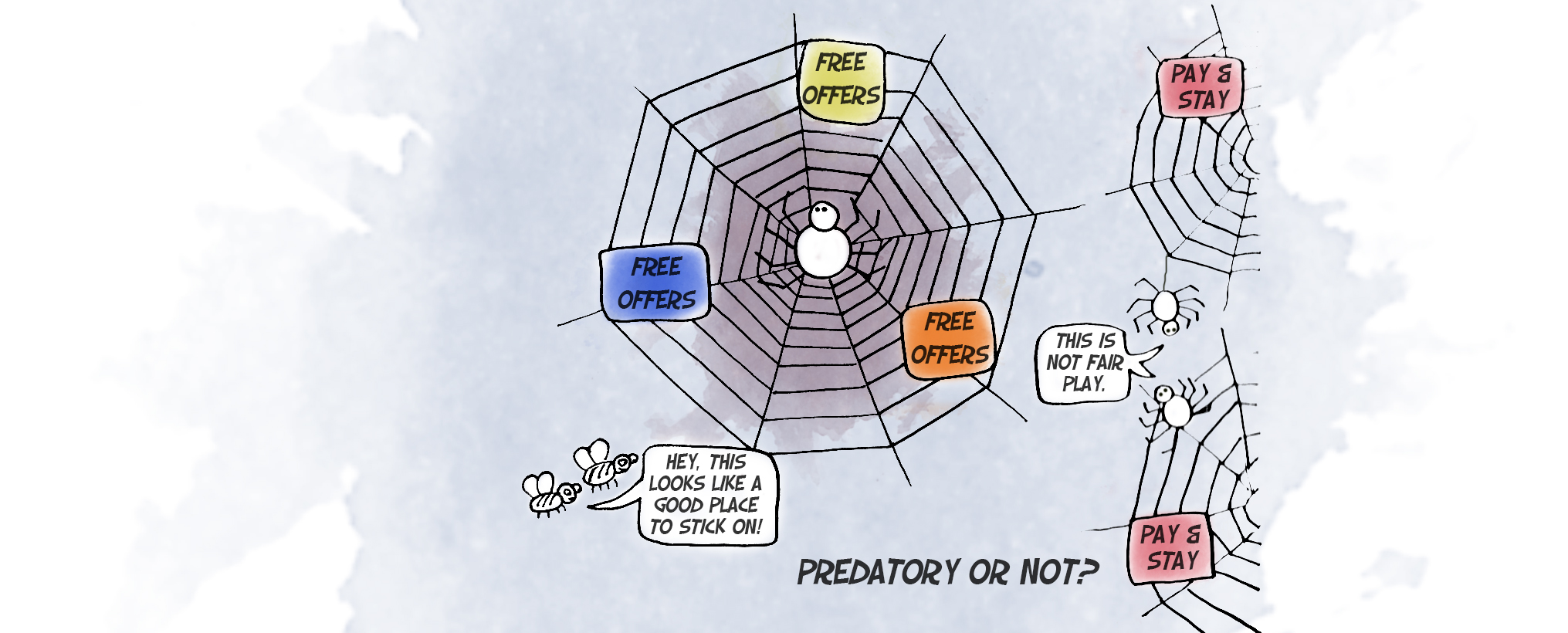

In the abstract she says, “Although Amazon has clocked staggering growth, it generates meager profits, choosing to price below-cost and expand widely instead.”īut if Amazon is selling below-cost, where does the money come from to finance those losses? In 2017, Lina Khan, then a law student at Yale, published “ Amazon’s Antitrust Paradox” in a note for the Yale Law Journal and used Evans’ chart as supporting evidence that Amazon was guilty of predatory pricing. Nonetheless, in those rare cases where plaintiffs can demonstrate that a firm actually has a viable scheme to drive competitors from the market with prices that are “too low” and has the ability to recoup its losses once it has cleared the market of those competitors, plaintiffs (including the DOJ) can prevail in court. Furthermore, even if a predator successfully clears the field of competition, in developed markets with deep capital markets, keeping out new entrants is extremely unlikely. Predatory pricing is a rather rare anticompetitive practice because the “predator” runs the risk of bankrupting itself in the process of trying to drive rivals out of business with below-cost pricing. He began with a chart of Amazon’s revenue and net income that has now become (in)famous:Ī question inevitably followed in antitrust circles: How can a company that makes so little profit on so much revenue be worth so much money? It must be predatory pricing!

In 2014, Benedict Evans, a venture capitalist at Andreessen Horowitz, wrote “ Why Amazon Has No Profits (And Why It Works),” a blog post in which he tried to explain Amazon’s business model.

0 kommentar(er)

0 kommentar(er)